Good faith discussions and comments only. This rule will be more strictly enforced based on how clickbaity an article is.Ĩ. Provide the link to the source article or paper.

If anyone is writing an article based on a Bank/investment group news release/white paper post the actual paper and not journalism surrounding it. This means if CNBC is reporting on something WSJ reported on we expect you to post the original article. Original Sourcing: articles posted must be from the original source on a best efforts basis. There is a 250 character requirement for posts.ħ. Making your own post devoid of in depth examination will likely result in it being removed. "now is the time to buy", "here's my thoughts", etc.

Do not post just an article, highlight the parts of the article you find relevant or offer some commentary surrounding the article.Īdditionally do not just make a self post to offer some simple thoughts. Effort: Posts must meet standards of effort. Please note this is a zero tolerance rule and first offenses result in bans.Ħ. Posts that are strictly self-interested or intended to "build awareness" are not acceptable.ĥ General corporate news and political posts must follow these guidelines. We generally expect that people who come here are not using the forum to build a brand, generate clicks, or shill. Do not post your youtube, twitter, discord, app, tool, blog, referral code, event, survey, etc. Violating this rule results in an automatic permanent ban. Strictly no (self-)promotion or solicitation threads.

#Real estate reit max drawdown skin#

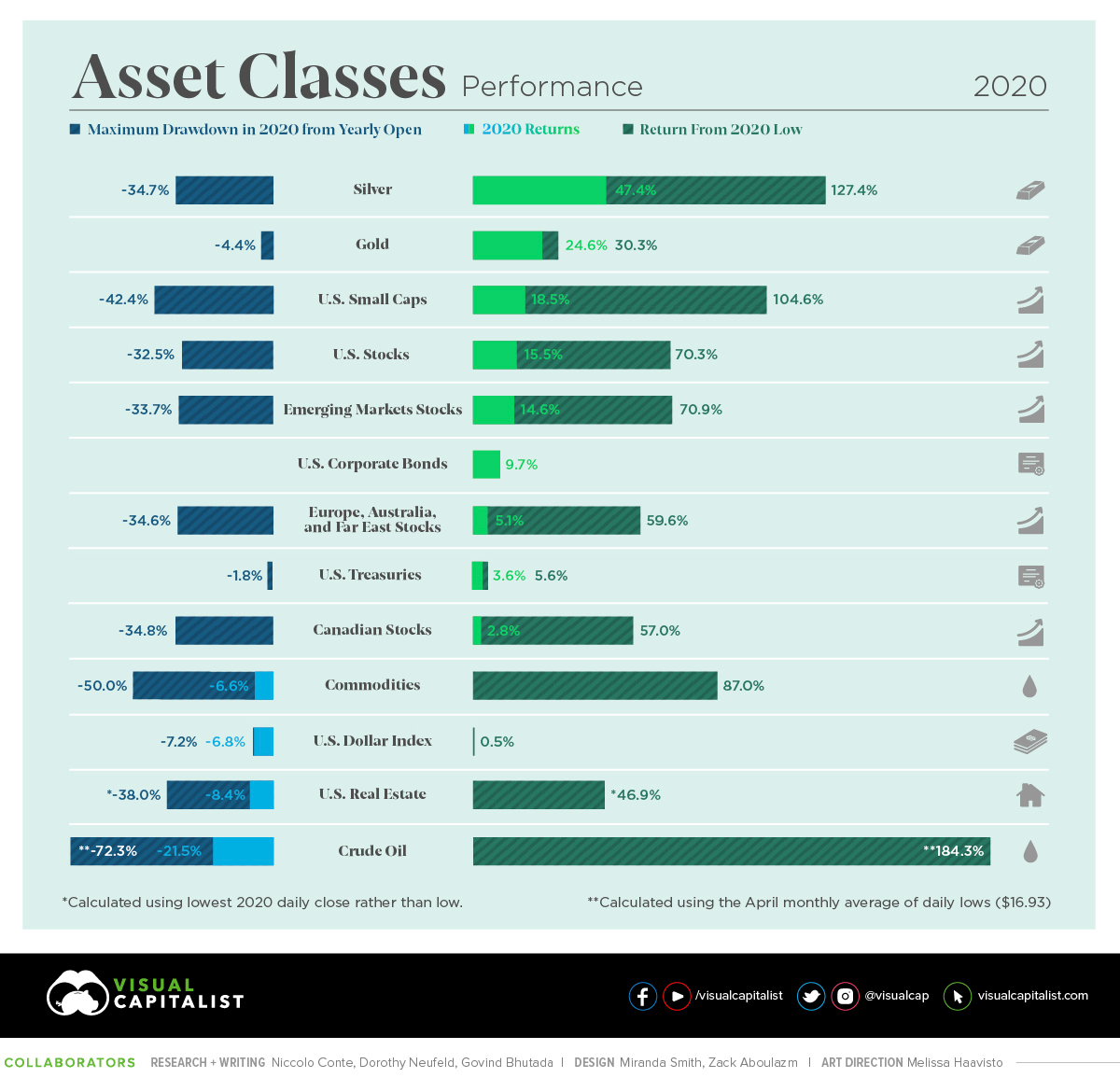

However, personal attacks, insults, trolling, or accounts dedicated to getting under the skin of others is not allowed, and will be banned.Ĥ. We recognize that this forum will generate differences of opinion, or misunderstandings of facts, and therefore arguments are expected. Off topic comments, attacks or insults will not be tolerated. Keep discussions civil, informative and polite. If your question likely has a "right answer", a beginner topic, you simply need help finding general investing information, or if it's asking for general input on what to do with your investments then post in the " Daily Advice and Discussion Thread".ģ. Do not make posts looking for advice about your personal situation. We generally expect that your topic incites responses relating to investing.Ģ. We are not a politics or general corporate news forum. Share investment ideas and insights or ask thoughtful investing discussion questions. Rebalance the portfolio monthly regardless of whether positions have been changed.1. Hold all positions until the last final trading day of the next month.Scenario 2: if the 12-month return of HYG is greater than LQD but lower than BIL, invest 25% of the portfolio in cash.Scenario 1: if the 12-month return of EFA is greater than SPY and BIL, invest 25% of the portfolio in EFA.For each slice, invest in the asset with the highest 12-month return as long as it is greater than the 12-month return of BIL.Calculate the 12-month return of each of the eight asset classes above and Short Term US Treasuries (BIL).Stress: Gold (GLD) and Long Term US Treasuries (TLT).Real Estate: REITs (VNQ) and US Mortgage REITs (REM).Bonds: High Yield Bonds (HYG) and US Corporate Bonds (LQD).Equities: US Large Cap Index (SPY) and International Equities (EFA).The funds in each slice are broadly based on components of the market: equities, bonds, real estate, and a “stress” category that typically reacts positively in a weak economy.Įach slice of the pie is made up of one of two ETFs: The portfolio is broken down into four equal-weighted slices of 25%.

0 kommentar(er)

0 kommentar(er)